Online Class: Understanding Financial Statements

no certificate

with CEU Certificate*

-

12Lessons

-

32Exams &

Assignments -

845Students

have taken this course -

7Hours

average time -

0.7CEUs

Course Description

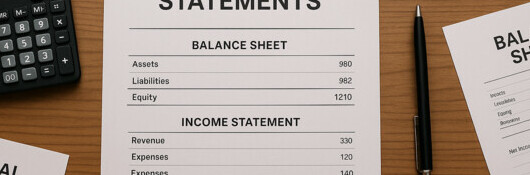

Deciphering Business Through its Financial DNA: Mastering the Art of Accounting

In the dynamic world of business, accounting isn't just numbers and ledgers; it's the very DNA, revealing the health, vitality, and potential of a company. Yet, truly understanding this DNA means diving deep into its core – the financial statements and reporting systems. These aren't mere documents, but rather strategic communication channels that unravel the intricate tales of a company's financial trajectory and vitality.

Why This Course Is A Game-Changer:

- Comprehensive Insight: Navigate through the maze of business finance, from foundational accounting stages to intricate GAAP principles.

- Tools of Financial Revelation: Delve into essential financial statements like the balance sheet, income statement, and more, demystifying their roles in painting a comprehensive financial portrait of a company.

- Applied Analysis: Journey beyond basic understanding to applied financial statement analysis. Learn the dance of cash flow, its rhythmic movement, and profound impact on business health.

- Ratio Revelations: Unravel the power of financial ratio analysis, a critical compass guiding investors towards informed, insightful investment decisions.

- Detective Skills for the Modern Business World: Step into the intriguing realm of accounting fraud. Understand its mechanisms, identify red flags, and delve into the dark arts employed by those who distort financial realities for deceptive gains.

Course Highlights:

- Building Blocks: Set your foundation with the fundamental principles of accounting and GAAP.

- Financial Statement Mastery: Develop expertise in reading, interpreting, and analyzing balance sheets, income statements, and other pivotal financial documents.

- Cash Flow Chronicles: Chart the journey of cash flow, understanding its ebbs and flows and the profound stories it tells about a company's health.

- Investor's Insight: Harness financial ratio analysis, turning raw numbers into strategic insights that empower investment choices.

- Guardians of Authenticity: Dive into the world of accounting fraud detection, equipping yourself with skills to safeguard businesses from deceptive practices and ensure financial integrity.

Empowering Decision-Makers:

Financial acumen transcends mere numbers; it's the bedrock upon which businesses are built, grown, and sustained. This course isn't just for aspiring accountants. It's for managers envisioning growth, investors seeking clarity, and any individual aiming to navigate the business world with confidence and competence.

Join us on this enlightening journey, where we transform the seemingly complex world of financial statements into a treasure trove of insights, strategies, and opportunities. Unlock the true language of business and equip yourself with the tools to interpret, analyze, and thrive in the financial landscape of tomorrow. Your voyage into mastering the financial DNA of business begins here.

- Completely Online

- Self-Paced

- 6 Months to Complete

- 24/7 Availability

- Start Anytime

- PC & Mac Compatible

- Android & iOS Friendly

- Accredited CEUs

Course Lessons

Lesson 1. GAAP and FASB: A Comprehensive Guide to Accounting Standards

Financial statements interlink to paint a comprehensive picture of a business's health, from assets to equity, while the double-entry bookkeeping system ensures balanced financial recording. U.S. SEC mandates public companies to adhere to GAAP, while private firms also find these principles beneficial.Lesson 2. Understanding Financial Statements: Essential Tools for Business Assessment

Strategic management of a company's finances involves detailed financial reporting with structured accounts including comprehensive balance sheets and income statements. This systematic approach enhances a firm's credibility and can lead to reduced financing costs and enhanced investment attractiveness.Lesson 3. Mastering Income Statements for Business Insights

The income statement, also known as the statement of operations, compiles a company's financial activities such as revenues, expenses, gains, and losses, across a period while employing principles like revenue and expense recognition. Its two main formats—single-step and multi-step—allow flexibility in presentation, aiding in financial analysis and decision-making for stakeholders without addressing actual cash movements.Lesson 4. Balance Sheet: A Key Financial Statement Explained

The balance sheet, a snapshot of a company's financial position at a specific time, is organized into assets, liabilities, and stockholders' equity. Understanding its structure, types, and the impact of debt and equity are crucial for assessing financial strength.Lesson 5. Understanding Stockholders' Equity: A Deep Dive

Real-world scenarios, like the story of oil prospectors Bill and Steve, demonstrate the importance of ownership share structures and the potential pitfalls in equity ownership not fully understood by some investors. Similarly, discussions about WH3 Corp. highlight critical elements of the stockholders' equity statement, such as retained earnings and dividend practices.Lesson 6. The Lifeblood of Business: Understanding Cash Flow Statements

Free cash flow, calculated by subtracting capital expenditures from operating cash flows, offers insights into a business's ability to sustain operations without external financing. It's a key indicator for investors assessing whether to invest in or lend to a business, especially during economic downturns.Lesson 7. Mastering Cash Flow and Working Capital Management

Understanding the interplay between working capital and cash flow is essential for ensuring a business can meet its financial obligations, with cash and working capital offering insights into liquidity and the ability to cover short-term liabilities. In this lesson, we explore analytical methods in accounting to assess the effects of business activities on financial health through cash flow analysis.Lesson 8. Ratio Analysis: Goals and Drawbacks

Financial ratios serve as a critical tool for assessing the efficiency and financial health of a business, providing an invaluable framework to gauge its ability to meet current liabilities. However, these metrics have inherent limitations, including potential distortions from factors like inflation, seasonality, and the diverse operations of multifaceted corporations.Lesson 9. Measuring Productivity: An Introduction to Financial Ratios

Liquidity ratios, such as the current and quick ratios, measure a company's ability to meet short-term obligations by comparing assets to liabilities. A healthy liquidity position indicates that a company can efficiently manage its cash flow and meet its financial commitments.Lesson 10. Financial Ratio Analysis Explained

Financial ratios serve as powerful tools in assessing a company's strategic use of assets and financial health, offering insights into liquidity, solvency, and profitability. The lesson covers key ratios and explains how to leverage trend analysis for monitoring growth or decline, with a focus on understanding various business contexts.Lesson 11. Fraud in Financial Statements

Financial statement fraud involves deliberate inaccuracies to mislead stakeholders—often through manipulation of GAAP standards or asset overstatements. It's crucial to understand motivation, opportunity, and rationalization—the fraud triangle.Lesson 12. Identifying Fraud in Financial Statements: A Practical Guide

The lesson elaborates on the deceptive financial manipulation tactic known as cooking the books, which involves falsifying financial statements to project favorable, yet inaccurate, financial results. It highlights the importance of the Sarbanes-Oxley Act of 2002, which enforces stringent auditing and reporting rules to protect stakeholders from corporate fraud.

Learning Outcomes

- Identify how GAAP principles, such as the historical cost principle, influence the preparation and reporting of financial statements.

- Recognize and categorize the primary components of financial statements including assets, liabilities, and equity in a balance sheet.

- Identify and describe the two primary types of SEC filings required for U.S. publicly traded companies, including filing timelines and associated forms.

- Recognize and classify the four main types of financial statements used during a standard reporting period, including their purpose and components.

- Calculate net income from an income statement using key formulas for gross margin and operating expenses with 95% accuracy.

- Identify and differentiate between single-step and multi-step income statement formats, using their distinct components and structures.

- Define and describe the three main components of a balance sheet: assets, liabilities, and stockholders' equity.

- Prepare and interpret a common-size balance sheet by converting each balance sheet item into a percentage of total assets.

- Analyze WH3 Corp's stockholders' equity statement, including concepts like treasury stock, par value, and additional paid-in capital, to understand changes in stockholders' equity.

- Explain the structure and purpose of the Statement of Stockholders' Equity in evaluating a corporation's financial health and ownership profile.

- Define and differentiate the three categories of cash flows—operating, investing, and financing—in a cash flow statement.

- Demonstrate the ability to calculate free cash flow using cash flow from operations, capital expenditures, and dividends paid.

- Describe the relationship between working capital and cash flow as it pertains to a company's ability to handle short-term liabilities.

- Demonstrate mastery of lesson content at levels of 70% or higher.

Additional Course Information

- Document Your Lifelong Learning Achievements

- Earn an Official Certificate Documenting Course Hours and CEUs

- Verify Your Certificate with a Unique Serial Number Online

- View and Share Your Certificate Online or Download/Print as PDF

- Display Your Certificate on Your Resume and Promote Your Achievements Using Social Media

Choose Your Subscription Plan

No Certificate / No CEUs

This course only

| Includes certificate | X |

| Includes CEUs | X |

| Self-paced |

|

| Instructor support |

|

| Time to complete | 6 months |

| No. of courses | 1 course |

Certificate & CEUs

This course only

| Includes certificate |

|

| Includes CEUs |

|

| Self-paced |

|

| Instructor support |

|

| Time to complete | 6 months |

| No. of courses | 1 course |

Certificates & CEUs

Includes all 600+ courses

| Includes certificate |

|

| Includes CEUs |

|

| Self-paced |

|

| Instructor support |

|

| Time to complete | 12 Months |

| No. of courses | 600+ |

Certificates & CEUs

Includes all 600+ courses

| Includes certificate |

|

| Includes CEUs |

|

| Self-paced |

|

| Instructor support |

|

| Time to complete | 24 Months |

| No. of courses | 600+ |

Student Testimonials

- "The course was very informative and helpful as a personal investor. I appreciated the lessons' content and format. Equally, the written content is easy to follow and reader friendly. Also, quick feedback on exams are insightful." -- Larry J.

- "It was very helpful - particularly the SOX discussion and the financial ratios." -- Mike B.

- "It was very helpful for someone of my limited knowledge on the subject." -- Christopher G.

Related Courses

-

36 hours

3.6 CEUs

Ultimate Secretary Training Bundle

+ More Info

36 hours

3.6 CEUs

Ultimate Secretary Training Bundle

+ More Info

-

25 hours

2.5 CEUs

Human Resources Productivity Course Bundle

+ More Info

25 hours

2.5 CEUs

Human Resources Productivity Course Bundle

+ More Info

-

19 hours

1.9 CEUs

Ultimate Excel Training Bundle

+ More Info

19 hours

1.9 CEUs

Ultimate Excel Training Bundle

+ More Info

-

72 hours

7.2 CEUs

Writing Help Course Bundle

+ More Info

72 hours

7.2 CEUs

Writing Help Course Bundle

+ More Info

-

17 hours

1.7 CEUs

ESL Basic Grammar and Writing

+ More Info

17 hours

1.7 CEUs

ESL Basic Grammar and Writing

+ More Info

-

14 hours

1.4 CEUs

Report Writing 101

+ More Info

14 hours

1.4 CEUs

Report Writing 101

+ More Info

-

7 hours

0.7 CEUs

Employment Law Fundamentals

+ More Info

7 hours

0.7 CEUs

Employment Law Fundamentals

+ More Info

-

14 hours

1.4 CEUs

QuickBooks Online

+ More Info

14 hours

1.4 CEUs

QuickBooks Online

+ More Info

-

6 hours

0.6 CEUs

Debt Reduction

+ More Info

6 hours

0.6 CEUs

Debt Reduction

+ More Info

-

7 hours

0.7 CEUs

Lean Management

+ More Info

7 hours

0.7 CEUs

Lean Management

+ More Info

-

7 hours

0.7 CEUs

Management Consultant 101

+ More Info

7 hours

0.7 CEUs

Management Consultant 101

+ More Info

-

7 hours

0.7 CEUs

Introduction to Logic

+ More Info

7 hours

0.7 CEUs

Introduction to Logic

+ More Info

-

7 hours

0.7 CEUs

Leadership Skills for Managers

+ More Info

7 hours

0.7 CEUs

Leadership Skills for Managers

+ More Info

-

5 hours

0.5 CEUs

All About Herbs

+ More Info

5 hours

0.5 CEUs

All About Herbs

+ More Info

-

7 hours

0.7 CEUs

Business Law for Entrepreneurs

+ More Info

7 hours

0.7 CEUs

Business Law for Entrepreneurs

+ More Info

-

4 hours

0.4 CEUs

Business Analysis

+ More Info

4 hours

0.4 CEUs

Business Analysis

+ More Info

-

4 hours

0.4 CEUs

Business Budgeting 101: How to Plan, Save, and Manage

+ More Info

4 hours

0.4 CEUs

Business Budgeting 101: How to Plan, Save, and Manage

+ More Info

-

7 hours

0.7 CEUs

Organizational Behavior in Business

+ More Info

7 hours

0.7 CEUs

Organizational Behavior in Business

+ More Info

-

11 hours

1.1 CEUs

Journaling and Memoir Writing

+ More Info

11 hours

1.1 CEUs

Journaling and Memoir Writing

+ More Info

-

5 hours

0.5 CEUs

The Art of Setting Goals

+ More Info

5 hours

0.5 CEUs

The Art of Setting Goals

+ More Info

-

8 hours

0.8 CEUs

Strategic Planning

+ More Info

8 hours

0.8 CEUs

Strategic Planning

+ More Info

-

7 hours

0.7 CEUs

Introduction to Ethics

+ More Info

7 hours

0.7 CEUs

Introduction to Ethics

+ More Info

-

8 hours

0.8 CEUs

Procurement Management

+ More Info

8 hours

0.8 CEUs

Procurement Management

+ More Info

-

3 hours

0.3 CEUs

Workplace Drug Use - An HR Guide

+ More Info

3 hours

0.3 CEUs

Workplace Drug Use - An HR Guide

+ More Info

-

5 hours

0.5 CEUs

Business Etiquette

+ More Info

5 hours

0.5 CEUs

Business Etiquette

+ More Info

-

9 hours

0.9 CEUs

Marketing 101

+ More Info

9 hours

0.9 CEUs

Marketing 101

+ More Info

-

12 hours

1.2 CEUs

Business Math 101

+ More Info

12 hours

1.2 CEUs

Business Math 101

+ More Info

-

6 hours

0.6 CEUs

Goal Setting for Business

+ More Info

6 hours

0.6 CEUs

Goal Setting for Business

+ More Info

-

6 hours

0.6 CEUs

Sustainable Development for Business

+ More Info

6 hours

0.6 CEUs

Sustainable Development for Business

+ More Info

-

8 hours

0.8 CEUs

Virtual Assistant 101

+ More Info

8 hours

0.8 CEUs

Virtual Assistant 101

+ More Info

-

10 hours

1.0 CEUs

Mastering Sales Skills 101

+ More Info

10 hours

1.0 CEUs

Mastering Sales Skills 101

+ More Info

-

5 hours

0.5 CEUs

Personal Finance 101: How to Manage Your Money

+ More Info

5 hours

0.5 CEUs

Personal Finance 101: How to Manage Your Money

+ More Info

-

8 hours

0.8 CEUs

SEO Copywriting

+ More Info

8 hours

0.8 CEUs

SEO Copywriting

+ More Info

-

5 hours

0.5 CEUs

Business Professionalism

+ More Info

5 hours

0.5 CEUs

Business Professionalism

+ More Info